arkansas estate tax statute

The change adopted 26 USC. However Arkansas cities and counties do collect property tax which is the principle local source of revenue for funding public schools.

Arkansas Legislators File Bill To Exempt State Taxes On Unemployment Compensation

AR K-1FE - Arkansas Income Tax Owners Share of Income Deductions Cridits Etc.

. Learn How to Create a Trust Fund with a Free Wells Fargo Estate Planning Checklist. Want to avoid paying. People who own real estate in Arkansas are required to pay property taxes every year to the county government where the property is located.

The State of Arkansas does not have a property tax. Thats the fifth lowest in the nation where the average is 31 percent and. Act 141 of Arkansas 91 st General Assembly exempts Military Retired Pay from Arkansas State Income Taxes.

Welcome to FindLaws section on Arkansas property and real estate laws covering statutes that govern the landlordtenant relationship homestead protection from creditors and more. States laws dictate that properties be assessed at 20 of their market value. Of all taxes collected in Arkansas state and local combined 181 percent comes from property taxes.

AR4FID Fiduciary Interest and Dividends. A In all cases where any tract of land may be owned by two 2 or more persons as joint tenants coparceners or tenants in common and one 1 or more proprietors shall have. Arkansas military retirement pay is exempt from state taxes.

For instance if your home has an appraised value of 200000 the assessed value would be 200000 x 20. 1 allowing businesses a deduction limitation for expensing of property of 1000000 which has been subject to. The amount of taxes due.

The Real Property Transfer Tax is levied on each deed instrument or writing by which any lands tenements or other realty sold shall be granted assigned transferred or. Ad The Leading Online Publisher of National and State-specific Elder Law Legal Documents. Ad Get the Personal Advice You Need To Start Planning A Living Trust.

179 as it existed Jan. Reduce property taxes for yourself or others as a legitimate home business. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Ad Reduce property taxes for yourself or residential commercial businesses for commissions. Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax. Online payments are available for most counties.

Is There An Inheritance Tax In Arkansas

6 States That Just Lowered Their Tax Rates

Arkansas Estate Tax Everything You Need To Know Smartasset

White Makes President S List At Southern Arkansas Announcements Tullahomanews Com

Arkansas House Senate Pass Income Tax Cut Legislation In Special Session Kark

Arkansas Quit Claim Deed Form Quites The Deed Arkansas

The Ultimate Guide To Arkansas Real Estate Taxes

Recreational Land For Sale Cherokee Village Arkansas 72529 Price 950 In 2022 Cherokee Village Land For Sale Lots For Sale

Eliminating Its Income Tax Will Help Arkansas S Economy

Guide To Arkansas Closing Costs In 2021 Newhomesource

Arkansas State Tax Guide Kiplinger

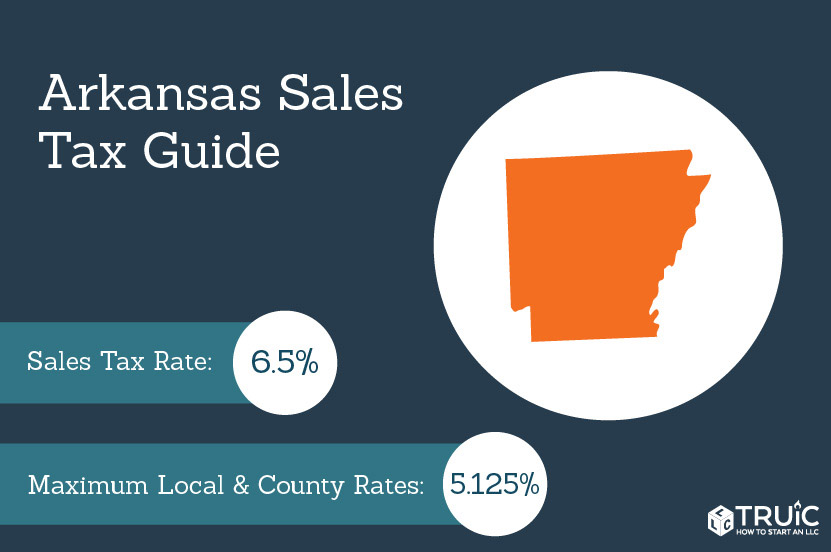

Arkansas Sales Tax Small Business Guide Truic

Arkansas Estate Tax Everything You Need To Know Smartasset

Learn More About Arkansas Property Taxes H R Block

Arkansas Governor Signs Accelerated Tax Cuts School Safety Funding Into Law

Tax Legislation For 2022 Arkansas House Of Representatives

Arkansas Tax Cuts Arkansas Tax Reform Tax Foundation

Arkansas Governor Signs Accelerated Tax Cuts School Safety Funding Into Law